Featured

Table of Contents

- – The Main Principles Of Why Hesitating Your Deb...

- – The Greatest Guide To Actual Stories from Deal...

- – Unknown Facts About Categories of Dealing wit...

- – The Student Loan Debt Forgiveness Solutions S...

- – The Greatest Guide To Real Testimonials of D...

- – The Ultimate Guide To Forms of Debt Forgiven...

Using for credit scores card debt mercy is not as easy as requesting your balance be removed. Financial institutions do not conveniently provide debt forgiveness, so recognizing exactly how to present your situation properly can enhance your chances.

I would love to go over any choices readily available for decreasing or resolving my debt." Debt mercy is not an automated option; in a lot of cases, you need to work out with your financial institutions to have a part of your equilibrium minimized. Bank card business are frequently open to negotiations or partial mercy if they believe it is their ideal opportunity to recoup several of the cash owed.

The Main Principles Of Why Hesitating Your Debt Problems Makes Things Worse

If they use complete mercy, get the arrangement in writing before you accept. You might require to submit an official created demand clarifying your hardship and just how much forgiveness you require and supply paperwork (see following area). To bargain properly, attempt to recognize the financial institutions placement and use that to offer a strong situation as to why they need to collaborate with you.

Always guarantee you receive verification of any forgiveness, negotiation, or hardship plan in writing. Lenders may use less alleviation than you require.

The longer you wait, the a lot more fees and interest gather, making it more challenging to certify. Debt mercy involves lawful considerations that customers should know prior to proceeding. Customer protection regulations govern just how lenders manage mercy and negotiation. The complying with federal legislations aid protect customers seeking financial debt forgiveness: Prohibits harassment and abusive debt collection techniques.

The Greatest Guide To Actual Stories from Dealing with Property Tax Escrow Shortages: When to Call a Housing Counselor Users

Needs lenders to. Restricts financial debt settlement companies from billing upfront fees. Understanding these defenses assists prevent rip-offs and unjust financial institution techniques.

Making a payment or also recognizing the financial obligation can reboot this clock. Even if a financial institution "costs off" or creates off a debt, it doesn't indicate the financial debt is forgiven.

Unknown Facts About Categories of Dealing with Property Tax Escrow Shortages: When to Call a Housing Counselor You Need to Know About

Before concurring to any kind of payment strategy, it's a great concept to inspect the statute of limitations in your state. Lawful implications of having financial obligation forgivenWhile financial obligation mercy can eliminate monetary concern, it comes with potential legal consequences: The internal revenue service treats forgiven debt over $600 as gross income. Customers receive a 1099-C form and should report the quantity when filing taxes.

Here are some of the exceptions and exceptions: If you were insolvent (indicating your complete financial debts were more than your overall possessions) at the time of mercy, you may exclude some or all of the terminated financial obligation from your taxable earnings. You will require to submit Form 982 and affix it to your income tax return.

While not connected to bank card, some student loan forgiveness programs enable debts to be canceled without tax repercussions. If the forgiven financial debt was associated to a certified farm or company procedure, there may be tax obligation exclusions. If you don't qualify for debt mercy, there are different debt relief strategies that may benefit your scenario.

The Student Loan Debt Forgiveness Solutions Statements

You obtain a brand-new loan huge enough to settle all your existing credit card balances. If authorized, you utilize the brand-new car loan to pay off your bank card, leaving you with just one month-to-month repayment on the combination funding. This streamlines financial debt management and can conserve you cash on rate of interest.

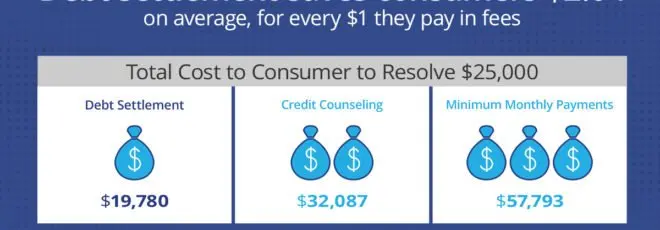

Crucially, the agency works out with your lenders to decrease your passion rates, significantly lowering your total debt worry. They are a fantastic financial debt remedy for those with inadequate credit scores.

Allow's encounter it, after a number of years of higher rates, cash doesn't reach it made use of to. Regarding 67% of Americans claim they're living paycheck to income, according to a 2025 PNC Bank research, which makes it tough to pay down debt. That's especially true if you're lugging a large financial obligation equilibrium.

The Greatest Guide To Real Testimonials of Debt Relief Recipients

Loan consolidation finances, financial obligation monitoring plans and repayment methods are some techniques you can make use of to lower your financial obligation. Yet if you're experiencing a significant monetary difficulty and you've worn down other alternatives, you may take a look at financial obligation forgiveness. Debt mercy is when a lender forgives all or several of your impressive balance on a car loan or other credit score account to help alleviate your financial debt.

Financial debt forgiveness is when a lender consents to wipe out some or all of your account equilibrium. It's a technique some individuals utilize to lower financial debts such as credit score cards, personal car loans and pupil fundings. Protected financial obligations like home and cars and truck loans typically do not qualify, given that the lender can recuperate losses by taking the security with repossession or foreclosure.

Federal trainee loan mercy programs are just one of the only ways to clear a financial debt without repercussions. These programs apply only to federal student lendings and often have stringent qualification regulations. Personal trainee lendings do not receive forgiveness programs. One of the most popular choice is Civil service Financing Mercy (PSLF), which eliminates continuing to be federal car loan balances after you function full-time for a qualified employer and make payments for 10 years.

The Ultimate Guide To Forms of Debt Forgiveness Offered Today

That indicates any kind of nonprofit hospital you owe may be able to supply you with financial obligation relief. Majority of all united state healthcare facilities offer some form of clinical financial obligation alleviation, according to patient solutions support group Dollar For, not simply nonprofit ones. These programs, typically called charity care, minimize and even eliminate clinical bills for professional individuals.

Table of Contents

- – The Main Principles Of Why Hesitating Your Deb...

- – The Greatest Guide To Actual Stories from Deal...

- – Unknown Facts About Categories of Dealing wit...

- – The Student Loan Debt Forgiveness Solutions S...

- – The Greatest Guide To Real Testimonials of D...

- – The Ultimate Guide To Forms of Debt Forgiven...

Latest Posts

The Greatest Guide To Does Online vs Phone Credit Counseling: Which Format Is Right for You? Appropriate for Your Situation

Excitement About The Truth About Debt Forgiveness and How It Works

Some Known Incorrect Statements About Federal Programs for Financial Assistance

More

Latest Posts

The Greatest Guide To Does Online vs Phone Credit Counseling: Which Format Is Right for You? Appropriate for Your Situation

Excitement About The Truth About Debt Forgiveness and How It Works

Some Known Incorrect Statements About Federal Programs for Financial Assistance